Commercial Property Insurance

Owning or managing commercial property comes with significant responsibilities. Whether you lease offices, run retail units, or let industrial premises, unexpected risks like fire, flood, or tenant damage could result in major financial loss.

Commercial property insurance ensures your buildings, tenants, and income are protected, so you can safeguard your investment and focus on running your business.

START YOUR QUOTE

CALL US

OR CALL 0330 054 0545

How It Works

1

Call us or complete our online quote form. We’ll collect a few key details about your business.

2

We’ll contact you to confirm everything, talk through your needs, and match you with the right level of cover.

3

We compare quotes from our panel of 20+ insurers, present your options, and explain the details before you buy.

Insurance Revolution's Reviews

Why Choose Insurance Revolution for Commercial Property Insurance?

Specialist Expertise: We understand the risks of owning or managing commercial property.

Tailored Cover: Policies built to protect your premises, tenants, and income.

Competitive Quotes: Access to a panel of trusted UK insurers.

Fast & Hassle-Free Setup: Cover can often be arranged the same day.

Flexible Payments: Spread the cost with affordable monthly instalments.

GET YOUR QUOTE NOW

CALL US

OR CALL 0330 054 0545

What Is Commercial Property Insurance?

Commercial property insurance (sometimes called commercial premises insurance) is designed to protect buildings used for business purposes. It typically covers the structure, fixtures, and fittings of your property against risks like fire, flood, storm, and vandalism. Policies can also include commercial landlord insurance, covering loss of rent and liability if you let your property to tenants.

Who needs Commercial Property Insurance?

This type of cover is essential for:

-

Commercial landlords renting offices, shops, or industrial premises

-

Businesses that own their own buildings

-

Property investors with mixed commercial portfolios

-

Developers with completed but tenanted properties

Why Do You Need Commercial Property Insurance?

Without the right protection in place, one incident could cause huge losses. Commercial building insurance helps you:

-

Protect your asset from structural damage caused by fire, flood, or storm

-

Safeguard rental income with loss of rent cover

-

Meet legal and contractual obligations with landlord liability protection

-

Cover fixtures and fittings within your property

-

Provide peace of mind for both you and your tenants

What Does Commercial Property Insurance Cover?

A tailored policy may include:

-

Buildings Insurance – Covers the property structure against fire, flood, storm, or vandalism.

-

Landlord Insurance – Protects against tenant damage and loss of rent.

-

Public Liability Insurance – Covers claims if someone is injured on your property.

-

Employers’ Liability Insurance – A legal requirement if you employ staff for property management.

-

Contents & Fixtures Cover – Protects fixtures, fittings, and equipment in the building.

-

Loss of Rent Insurance – Provides income cover if tenants cannot occupy the property due to an insured event.

-

Legal Expenses Cover – Assists with tenant disputes or property-related claims.

FAQs

While not a legal requirement, most mortgage lenders and commercial landlords require buildings insurance as a condition of ownership.

Commercial property insurance protects the building itself, while commercial landlord insurance extends to cover rental income, tenant disputes, and liability risks.

Yes. A commercial property portfolio can be covered under a single policy for ease and cost efficiency.

Standard policies may not cover vacant properties, but we can arrange specialist unoccupied property insurance if required.

START YOUR QUOTE

CALL US

OR CALL 0330 054 0545

Helpful Articles & Updates

From liability cover to loss of licence, this section provides insurance help and business advice for business owners.

Well Dunn Group is pleased to confirm a new strategic partnership with premium finance provider PremFina . This collaboration will enable us to offer improved premium finance options to customers... Most landlord insurance claims follow familiar patterns. But the emerging pattern in 2025–26 is how often they happen and how much they cost. Rising repair prices and more extreme weather...

A commercial property incident — whether fire, flood, theft or structural failure — can be disruptive and costly. Acting quickly and carefully, while following your insurance policy, helps

protect your...Dumper trucks are tough machines, but they’re not immune to risk. From theft to tip-overs, the types of claims insurers see from UK construction and groundwork firms often follow a...

Whether you own your dumper trucks or hire them in for specific jobs, the type of insurance you need can differ significantly. Confusing these two could leave you underinsured, or...

Dumper trucks are essential for moving heavy loads on construction and groundwork sites but they’re also high-risk machines prone to accidents, theft and damage. Whether you own or hire a...

As UK businesses shift toward greener operations, electric forklifts are becoming more popular but does the type of forklift you use affect your insurance policy or premium?

In this blog,...

A forklift accident can cause serious injury, property damage and costly downtime and if you're found liable, the financial consequences can be severe. That’s why forklift liability insurance is one...

Whether you run a warehouse, construction site, or manufacturing facility, forklift trucks are essential for moving heavy loads. But are they legally required to be insured? And what kind of...

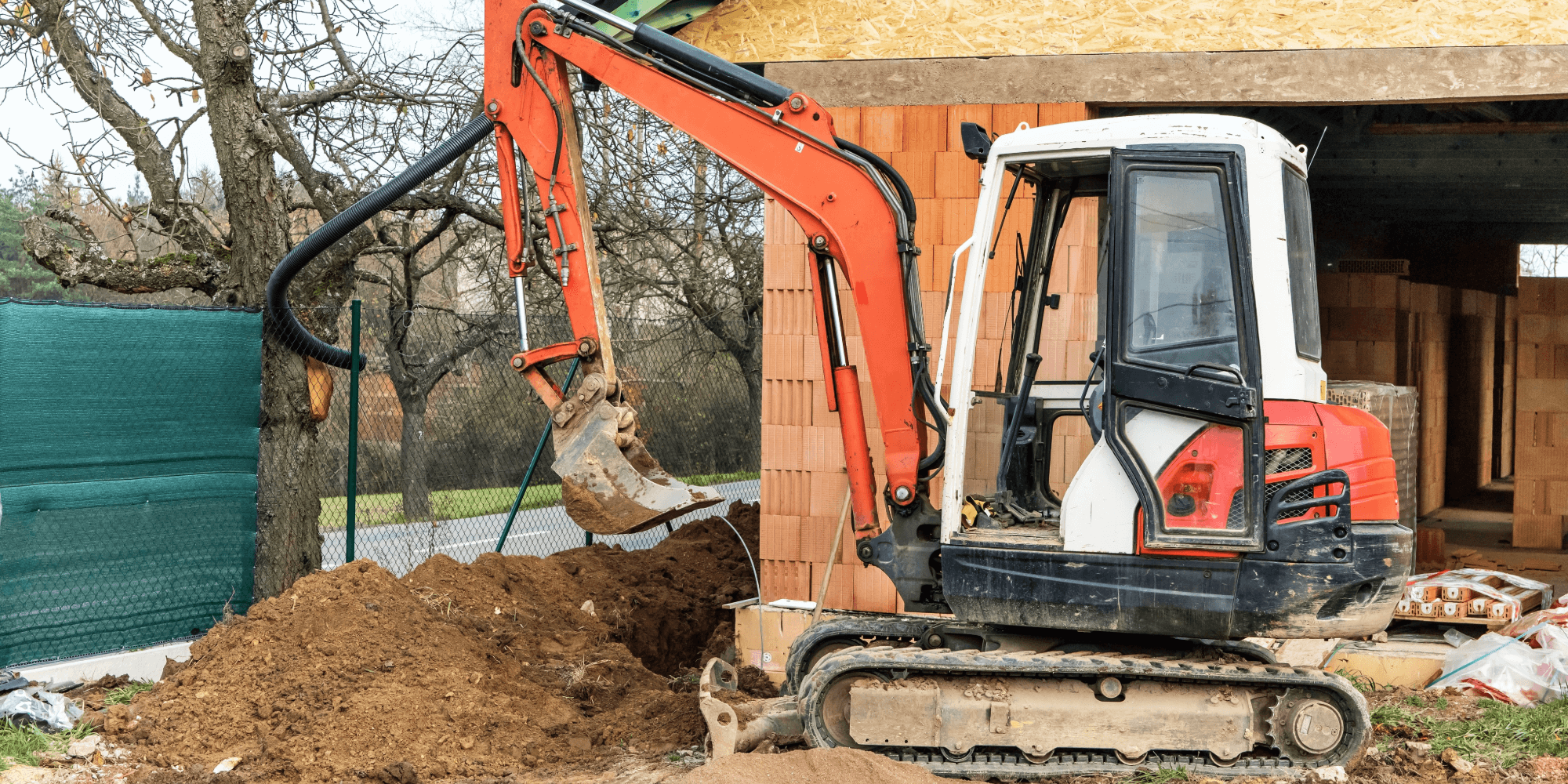

Excavators and mini diggers are among the most stolen types of plant equipment in the UK. With units valued anywhere from £15,000 to over £200,000, one theft can devastate your...

Not all diggers are treated equally when it comes to insurance. Whether you’re operating a compact mini digger for landscaping or a large excavator for major groundwork, the type of...

If you operate a digger or excavator whether it’s a mini digger, tracked machine or wheeled unit, having the right insurance isn’t just a box-tick exercise. With high theft rates,...

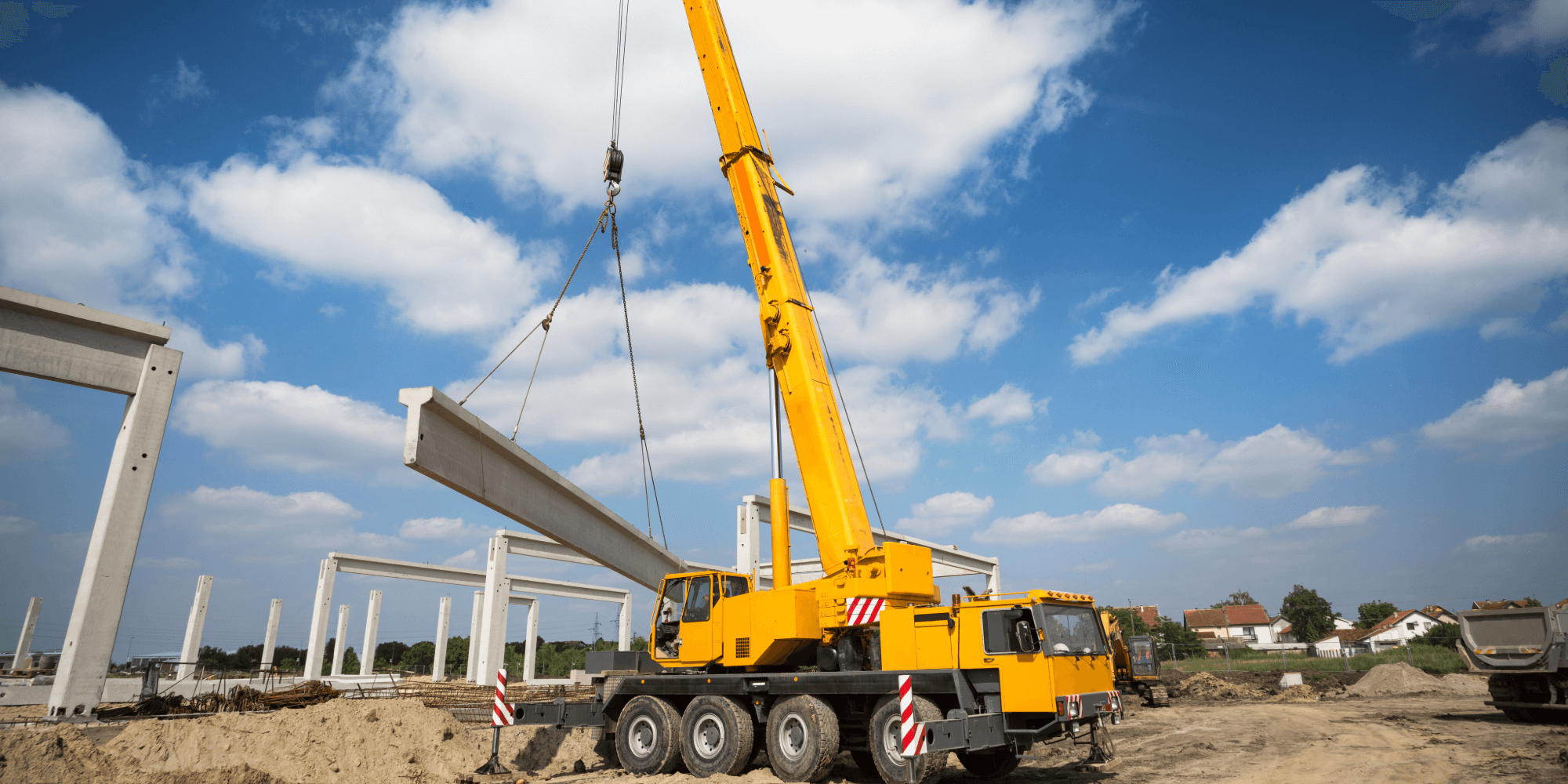

Crane operations are some of the most high-risk activities on a construction site. A single incident can lead to serious injury, project delays, and six-figure insurance claims. Whether you're operating...

Hiring a crane for a lifting job might seem straightforward but when something goes wrong, who’s responsible? If you're hiring cranes under CPA or similar terms, assuming the crane hire...

Crane operations come with high risk and high value, so getting the right insurance matters. But not all cranes are covered the same way. If you operate mobile cranes or...

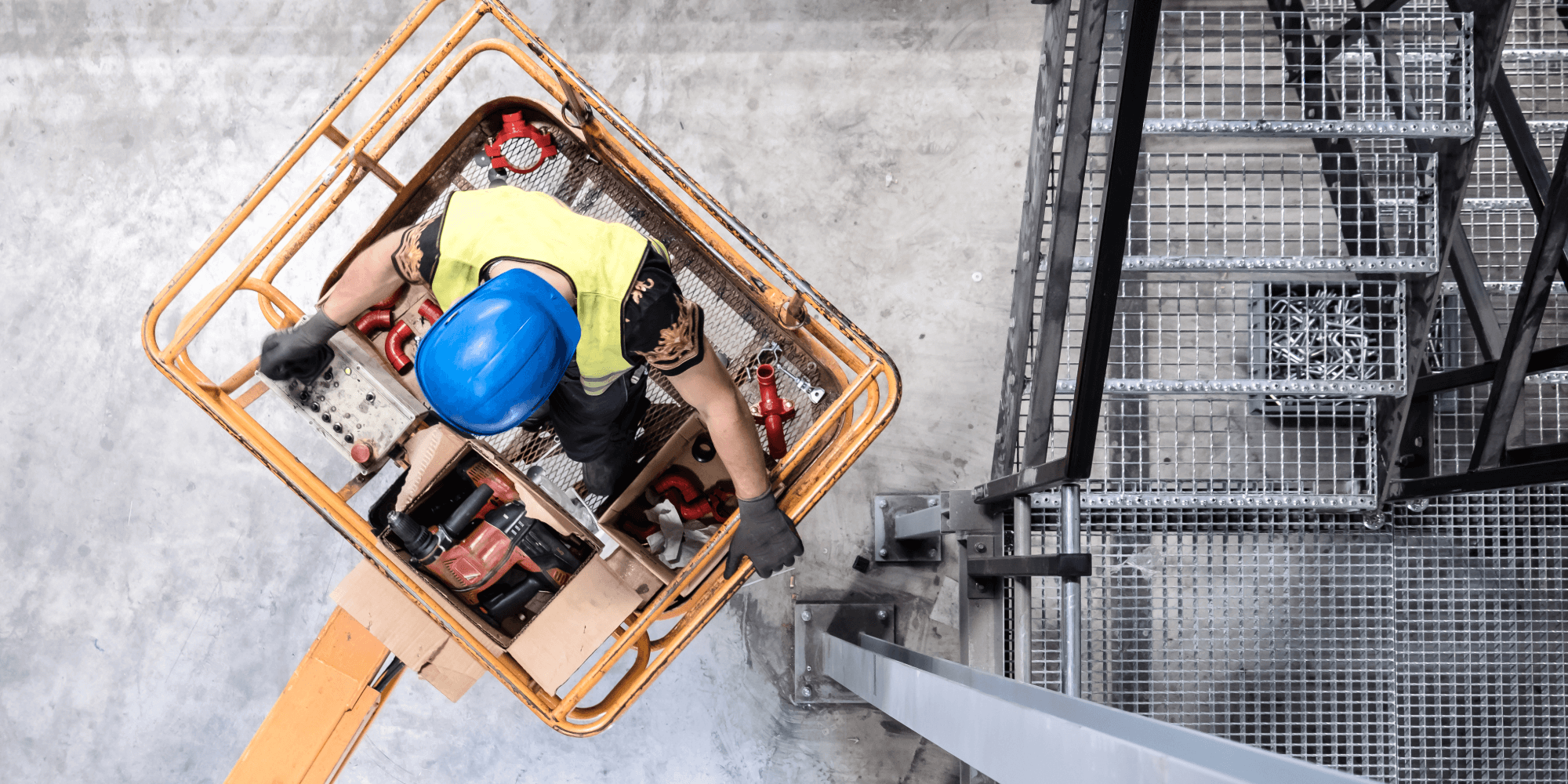

Running cherry pickers for your business can be expensive and insurance is a necessary but sometimes overlooked cost. The good news? There are plenty of ways to reduce the cost...

Using cherry pickers or mobile elevated work platforms (MEWPs), comes with strict safety and legal responsibilities. Whether you're operating on a private site or driving on public roads, non-compliance can...

Whether you own a single MEWP or manage a fleet of access platforms, Cherry Picker Insurance is essential to protect your business from the high risks associated with working at...

Whether you operate a single excavator or manage a fleet of machines across multiple sites, Plant & Machinery Insurance is vital for protecting your business. But do you know what...

If your construction business uses heavy machinery, understanding the difference between hired-in plant insurance and owned plant cover is essential. Many UK contractors assume their policy protects everything, but if...