Business Vehicle Insurance

As one of the UK’s leading business vehicle insurance brokers, we compare from multiple insurers to find flexible cover, competitive prices, and expert support. Our UK-based team ensures you get the right protection, so your vehicles, drivers, and business stay covered when it matters most.

1

Request a Quote Call us or complete our online quote form. We’ll collect a few key details about you, your vehicles, and your business needs.

2

Discuss Your Needs Our team will contact you to confirm your details, talk through your requirements, and match you with the right level of cover.

3

Compare and Choose We compare quotes from our panel of insurers, then present your options and explain the details before you buy.

Insurance Revolution's Reviews

Business Vehicle Insurance: What You Need to Know

Business vehicle insurance brings together essential coverages like third-party liability, comprehensive collision cover, and more to safeguard any cars, vans, trucks, or other vehicles you use for work. It essentially extends your protection beyond personal use to include business activities, from driving between job sites to carrying goods or passengers for hire.

This means that if one of your work vehicles is involved in an accident or theft, or causes injury/damage to someone else, your policy has you covered. Crucially, business vehicle policies carry higher liability limits (to handle costly claims) and are structured for the greater risks that come with commercial driving. Standard car insurance won’t usually cut it for business use, so having the right policy in place is vital to avoid being caught out by a denied claim or legal issues.

At Insurance Revolution, we provide flexible business vehicle insurance tailored to all types of UK enterprises, from sole traders to large fleets. Whether you need cover for a single car or a mix of vans and trucks, we match you with the right policy so you only pay for what you need. Our experts help identify the correct class of business use (Class 1, 2 or 3) and ensure full legal compliance. With the right cover in place, you’re protected from day-to-day risks and major incidents, keeping your vehicles, and your business, moving.

Common Risks in Business Vehicle Operations

From minor bumps on a busy commute to a van full of tools being stolen overnight, businesses that rely on vehicles face risks every day. Road accidents are the most common threat, a collision could injure your driver or others and lead to costly repairs or liability claims. There’s also the risk of vehicle theft or vandalism, bringing unexpected replacement costs and downtime. If you carry goods or equipment, these can be damaged or stolen too, affecting your ability to work. And when a vehicle is off the road, your business can lose valuable time and income until it’s back in service.

Without the right business vehicle insurance, legal risks quickly escalate. If a driver isn’t properly insured and has an accident, your business could face hefty fines, liability claims, or lawsuits. One incident could seriously damage your finances and reputation. A robust commercial vehicle policy protects your business from accidents, theft, breakdowns, and legal exposure, keeping your vehicles and operations safeguarded.

FAQs

Any individual or company using a vehicle for work purposes beyond standard commuting should have business vehicle insurance. If you drive your own car to visit clients, carry equipment, deliver goods, or have employees drive company vehicles, a business (or commercial) policy is required. In the UK, you’re legally obliged to insure any vehicle used on the road for the correct usage. Importantly, a personal car insurance policy typically will not cover work-related driving (except simple commuting).

So, if you use vehicles in the course of your business, whether it’s a taxi, a van full of tools, a pool car shared by staff, or a lorry hauling goods, you need business vehicle insurance to stay protected and legal. This ensures that in the event of an accident or claim while working, your insurance will pay out and you won’t be personally liable for huge costs.

Yes. Business vehicle insurance can be set up to cover multiple named drivers or even “any driver” using the vehicle (as long as they have permission and a valid licence). An Any Driver policy offers maximum flexibility, any employee or team member can get behind the wheel and be insured, which is ideal if you have a pool vehicle or rotating drivers. However, this convenience can come with a higher premium.

Alternatively, you can opt for a named driver policy, listing specific people who will drive; this is often cheaper if you have a small, consistent team. We’ll help you decide which approach makes sense. For example, a small business might insure 2–3 named drivers on a van, while a taxi firm or large fleet might prefer any-driver cover so that any qualified staff are automatically insured. Either way, we ensure that all drivers are properly covered so there are no surprises when someone new gets behind the wheel.

A business vehicle policy typically covers all the same core risks as a personal auto policy – and then some extras tailored to commercial use. Fundamentally, it includes at least Third-Party Liability, which covers injuries to other people or damage to their property if your vehicle is involved in an accident (this is the minimum legal requirement).

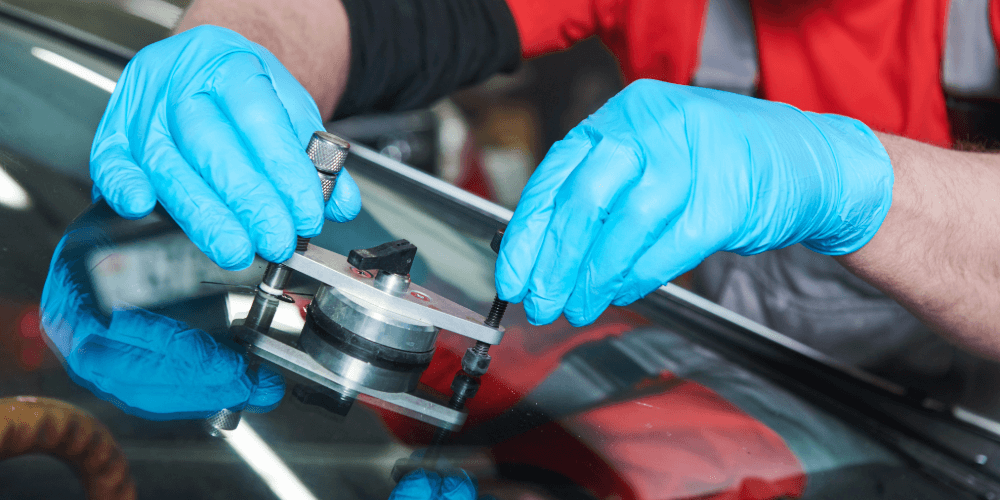

Most business policies will also cover accidental damage, fire, and theft for your own vehicle (especially if you choose comprehensive cover). In addition, you can expect features like coverage for windscreen repairs, and many policies include or offer add-ons such as breakdown recovery and roadside assistance, courtesy vehicle hire (to keep your business running if your van/car is in for repairs) and legal expenses coverage.

If you carry goods, tools, or stock, you can add cover for those contents as well. Essentially, business vehicle insurance is designed to keep your wheels turning, it protects against the common risks (accidents, breakdowns, theft) and the specific needs of business users (like covering multiple drivers, contents, or higher liability limits). When arranging your policy, we’ll help you choose the right combination of coverages so everything important is protected.

Absolutely. Business vehicle insurance isn’t one-size-fits-all and that’s where we shine as a specialist broker. We work with you to customise the policy so it fits your exact requirements. This means you can choose the coverage levels and options that make sense for your business.

For example, you might want to include any-driver cover if you have many employees driving, or you may opt for named drivers to save on cost. You can add extras like breakdown cover, tools or cargo cover, or increased liability limits if your work demands it.

The policy can also be structured around your fleet size: whether you need to insure just one vehicle or fifty, we can arrange multi-vehicle or fleet policies to simplify management. At Insurance Revolution, our philosophy is that you should only pay for what you need – but also get everything you need.

We’ll ask about how your business operates, the types of vehicles and journeys involved, and any special concerns (for instance, younger drivers under 25, or driving abroad) to ensure your insurance package is spot on. The end result is a bespoke policy that gives you full protection and peace of mind, without waste or unnecessary costs.

It can be, yes, mainly because driving for work typically involves higher risk than personal driving. Insurers take into account that business vehicles often cover more miles, spend more time on the road (often during peak traffic or long-distance trips), and may be driven in unfamiliar areas or under tighter schedules.

You might also be carrying passengers (e.g. taxi clients) or valuable goods/equipment, which adds to the potential liability. All these factors mean there’s a greater chance of accidents or claims, so premiums for business use are usually higher to reflect that risk. In fact, studies show that business drivers face hazards like heavy rush-hour traffic, long hours behind the wheel, and the need to drive in all sorts of conditions, which increases the likelihood of incidents. However, every case is different.

The cost will also depend on things like the driver’s experience, the type of vehicle, your location, and exactly what you’re using the vehicle for. The good news is there are ways to keep costs reasonable. For example, maintaining a good driving record and no-claims bonus, using telematics or dash cams, securing your vehicles (alarms, safe parking), and choosing the right excess can all help reduce premiums.

Combining multiple vehicles under a fleet policy or any multi-vehicle discount can also save money. Our experts will work with you to find the most cost-effective solution without sacrificing the cover you need. Remember, while business insurance might be a bit more expensive upfront, it’s far cheaper than paying out of pocket for a big claim that isn’t covered by the wrong policy.