Driving in the UK can be challenging at the best of times, but in certain cities, it becomes a serious test of patience. From endless congestion to confusing one-way systems and limited parking, some urban areas make daily driving feel more like endurance than convenience.

For business owners and everyday motorists alike, understanding which cities are hardest to drive in is more than curiosity. It can directly influence insurance costs, vehicle wear and tear, and time spent on the road.

This guide explores the hardest cities to drive in across the UK and explains what these conditions mean for car insurance and business vehicle cover.

Why Some UK Cities Are So Hard to Drive In

A city’s driving difficulty is shaped by several factors:

-

Traffic congestion and peak-hour delays

-

Road layout complexity and confusing signage

-

Parking availability and cost

-

Frequency of collisions and claims

-

Weather conditions and infrastructure quality

These challenges not only create frustration but also increase the likelihood of accidents and insurance claims. Over time, this drives up average premiums, particularly for urban motorists and businesses operating fleets in city centres.

London: The Capital of Congestion

London remains the UK’s most difficult city for drivers. On average, motorists lose over 150 hours per year in traffic, making it one of the most gridlocked cities in Europe.

Key challenges include:

-

The Congestion Charge and Ultra Low Emission Zone (ULEZ) costs

-

Frequent roadworks and diversions

-

Scarce and expensive parking spaces

-

High collision and claim rates in busy central boroughs

The result is that car insurance premiums in London tend to be significantly above the UK average. For businesses running multiple vehicles, a fleet policy can help consolidate costs while providing consistent cover for high-risk urban routes.

Birmingham: Construction and Constant Congestion

Birmingham has undergone major redevelopment in recent years, but its road network still struggles under heavy traffic. Drivers regularly face long delays on key routes, with road closures and construction zones adding to the chaos.

The city centre’s one-way systems confuse even experienced locals, and congestion around commuter corridors is near constant. These conditions contribute to higher-than-average accident statistics, which naturally impact insurance risk ratings.

For delivery drivers and service businesses, downtime from traffic incidents can disrupt operations. A tailored commercial motor insurance policy should include replacement vehicle cover to keep your business moving even when one vehicle is out of action.

Manchester: A Perfect Storm of Traffic and Tight Layouts

Manchester is one of the busiest cities in the North, with a growing population and high student density. Commuters often face severe delays, averaging over 35 minutes per 10km during rush hour.

Narrow city streets, heavy pedestrian zones, and continuous roadworks all add to the frustration. The result is frequent low-speed collisions and a higher risk profile for insurers.

Local delivery drivers, taxi operators, and tradespeople often pay more for motor or van insurance due to this risk exposure. Businesses can mitigate this by considering small fleet insurance with flexibility for multiple drivers.

Edinburgh: Historic Charm, Modern Headaches

Edinburgh’s historic architecture and cobblestone streets make for beautiful views but difficult driving. The city’s narrow lanes, restricted access zones, and tram line diversions cause ongoing congestion.

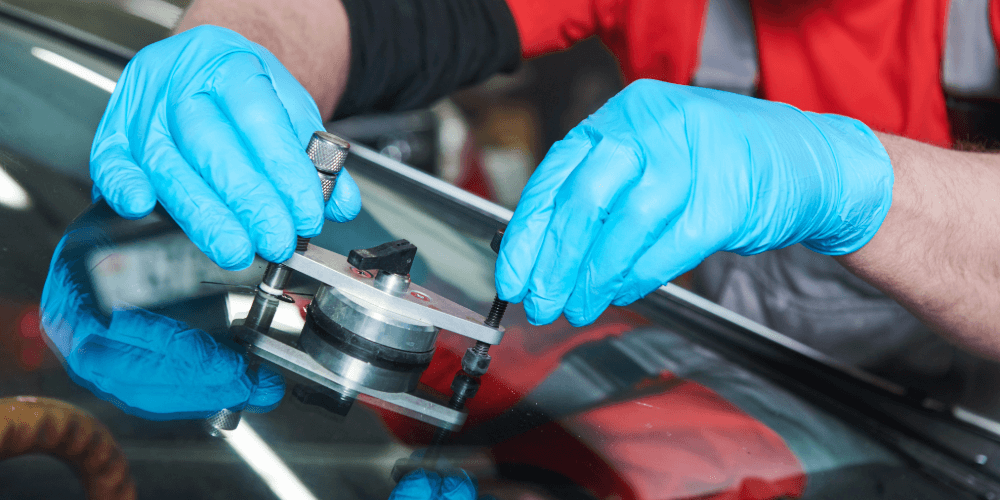

Parking in the city centre is limited and expensive, and the steep terrain can make winter driving especially challenging. Potholes and uneven roads also lead to a higher likelihood of tyre and suspension damage, which can lead to small but frequent claims.

Drivers and businesses here should look for comprehensive cover that includes windshield, tyre, and minor damage protection to offset the impact of urban driving conditions.

Bristol: Environmental Zones and Endless Roadworks

Bristol is a forward-thinking city with strong environmental goals, but this progress has added layers of driving difficulty. The Clean Air Zone (CAZ) and related restrictions mean drivers must remain alert to avoid fines, and frequent road closures only add to delays.

Narrow streets, bridge bottlenecks, and busy harbour areas create frequent gridlock. For business owners, these factors can lead to missed appointments, delivery delays, and higher operating costs.

Companies driving regularly in Bristol should ensure their policies include business interruption or vehicle downtime cover, providing a financial cushion if disruptions impact productivity.

Glasgow: Weather Meets Congestion

Scotland’s largest city regularly experiences both heavy traffic and poor weather, creating difficult driving conditions year-round. Rain, fog, and ice frequently affect visibility and road grip, particularly in winter months.

City centre speeds drop significantly during rush hours, and drivers commonly face long delays along main commuter routes. With frequent collisions and harsh weather contributing to claims, insurance costs in Glasgow are often higher than in comparable UK regions.

Fleet operators working across Scotland should consider comprehensive fleet insurance that protects vehicles and drivers across multiple locations, including urban and rural routes.

Other Cities Worth Mentioning

Several other UK cities deserve recognition for their driving challenges:

-

Leeds – Rapid expansion and limited parking in key areas.

-

Sheffield – Hilly topography and complex roundabout systems.

-

Cardiff – Narrow roads and growing commuter congestion.

-

Liverpool – Traffic around docks and event venues causes frequent gridlock.

Each city presents unique risks that can influence vehicle insurance pricing and claims frequency.

How Hard-to-Drive Cities Affect Your Insurance

Insurance providers calculate premiums based on a wide range of data, and city conditions play a key role. Common factors include:

-

Claim frequency and severity

-

Vehicle crime and vandalism rates

-

Population density and driver behaviour

-

Traffic volume and collision statistics

If you live or operate a business in one of the UK’s hardest cities to drive in, it’s essential to review your policy regularly. The right car or fleet insurance should include:

-

Comprehensive vehicle damage and theft cover

-

Replacement vehicle options for downtime

-

Public liability cover for third-party damage

-

Legal expenses cover for claims or disputes

These features help reduce the impact of operating in high-risk environments and ensure you are protected when the unexpected happens.

Smart Driving in the UK’s Hardest Cities

Driving in major UK cities will always come with challenges, but preparation and the right protection make all the difference. Whether you are navigating London’s congestion or Edinburgh’s cobbled hills, staying informed and insured is key.

Motorists and businesses should regularly review their insurance cover, use GPS or telematics systems to manage routes efficiently, and ensure vehicles are kept in top condition to reduce claim risks.

For tailored advice on car insurance, van insurance, or business fleet cover, speak to a broker who understands the unique pressures of driving in urban environments.

Sources:

INRIX Global Traffic Scorecard

https://inrix.com/scorecard

TomTom Traffic Index

https://www.tomtom.com/traffic-index

Department for Transport Road Congestion Statistics

https://www.gov.uk/government/collections/road-congestion-and-reliability-statistics

Department for Transport Road Safety (RAS) Data Tables

https://www.gov.uk/government/collections/road-accidents-and-safety-statistics

Association of British Insurers Claims Statistics

https://www.abi.org.uk

Police.uk Regional Road Incident Data

https://www.police.uk

Transport for London (TfL)

https://tfl.gov.uk

Birmingham City Council Clean Air Zone

https://www.birmingham.gov.uk/caz

Bristol Clean Air Zone

https://www.bristol.gov.uk/residents/streets-travel/bristol-caz

Edinburgh Traffic and Tram Updates

https://www.edinburgh.gov.uk/roads-travel-parking

Manchester City Council Traffic and Roadworks

https://www.manchester.gov.uk

Glasgow City Council Traffic Information

https://www.glasgow.gov.uk

Met Office Weather Impact Reports

https://www.metoffice.gov.uk

AppyParking UK Parking Data

https://www.appyway.com

Office for National Statistics Population Density Data

https://www.ons.gov.uk