No claims bonus is one of the biggest ways drivers save money on motor insurance. Most people understand it for private cars, but when they move into business vehicles, vans or company fleets, the rules change. Many drivers think they earn a bonus just by driving claim free at work. Others assume they can bring their private bonus across to a business policy. Both beliefs often turn out wrong. This guide explains how no claims bonus works for business vehicles, who owns it, how it can be transferred and how businesses can protect their discount.

What Is a No Claims Bonus?

A no claims bonus, sometimes called a no claims discount, reduces the cost of insurance if you do not make claims. Each year you stay claim free adds a year to your bonus. Five years of proven driving with no claims can lead to major savings.

Private drivers understand this. The confusion starts when drivers begin using vehicles for business.

Who Actually Owns the Bonus?

The answer depends on who owns the vehicle and who pays the policy.

Personal business use

If you own the vehicle personally and you add business use to your private policy, you own the bonus.

Company owned vehicles

If the business owns the vehicle, then the business earns any discount. Employees driving the vehicle do not.

Fleet insurance

Fleets do not usually earn a traditional bonus at all. Instead insurers rate fleets based on claims history, driver risk and loss ratios over time.

This is why drivers who use company vehicles for years often lose out when they move back to personal cover. They may need an introductory discount because they did not technically earn their own bonus.

Can You Transfer No Claims Bonus Between Policies?

Sometimes, but not always.

Personal NCB to a business van

Some insurers allow you to transfer your private car bonus to a personal van policy. Others do not, so it depends on the insurer.

Company NCB transferring

If a company changes commercial insurers, the discount can usually move across with proof of claims experience.

Private NCB to fleet policies

This rarely happens. Fleets are rated differently and do not use traditional discount structures.

Always check transfer rules before cancelling a policy, especially if you have built a long bonus.

Do Company Car Drivers Earn a Bonus?

Usually no.

If you drive a company car insured by your employer, your employer may earn a claims discount, not you. Even if you never make a claim, you personally did not insure the vehicle which means you did not collect a bonus.

Employees returning to private insurance after years in a company vehicle often face higher premiums because they appear as new drivers. A letter of driving experience from the employer may help insurers give a reduced rate.

How Fleets Get Rated Without NCB

Since fleets do not earn no claims bonus in the traditional sense, insurers use other measures to price them. These include:

-

Claims frequency data

-

Total loss costs

-

Vehicle type and usage

-

Driver age profiles

-

Telematics data

-

Compliance systems

A fleet with lots of claims will pay more, even if individual drivers caused none. A fleet with low incident rates benefits from better renewal pricing.

How to Protect No Claims Bonus on Business Vehicles

Both individuals and businesses can protect discounts and claims performance.

NCB protection add ons

These cost extra but stop the bonus dropping after one claim.

Telematics systems

Driver training

Simple coaching often cuts collision frequency.

Accident reporting procedures

Quick reporting stops claims escalating which keeps costs down.

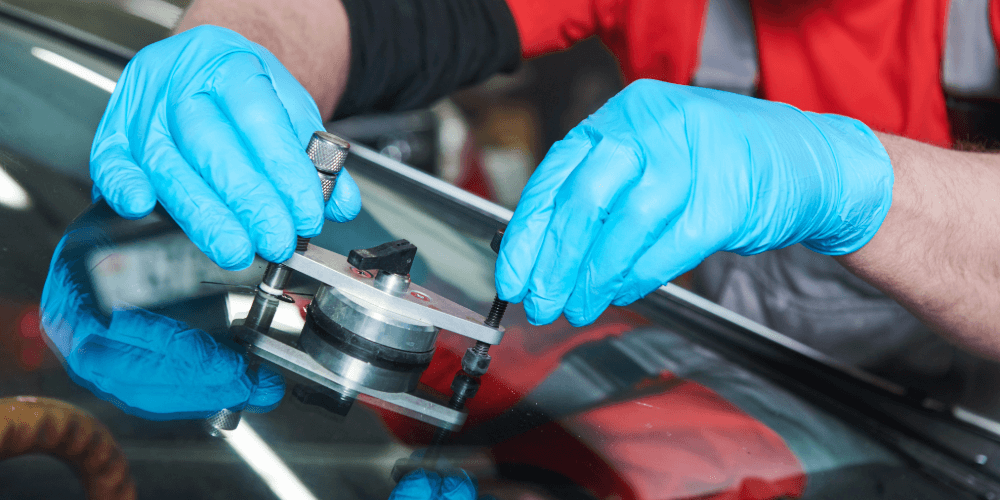

Regular vehicle maintenance

Fewer breakdowns and faults lead to fewer claims.

These risk control steps matter because commercial vehicles travel more miles and face greater accident exposure.

NCB and Vans: How It Differs

Van insurance sometimes treats NCB separately from private car policies. A driver with five years of private car NCB might not get full credit when switching to a van policy. Some insurers accept it, some reduce it, others refuse it.

This happens because commercial vans often:

-

Carry tools

-

Travel long distances

-

Operate in busy environments

Higher risk leads to stricter bonus rules.

NCB and Company Car Drivers: A Frequent Pain Point

Imagine someone who spent ten years driving a company car safely. They now buy their own vehicle. They expect years of no claims discount. Unfortunately, they usually have none.

To help, insurers may allow:

-

Proof of company driving history

-

A letter confirming no accidents

-

An introductory discount

This does not always match a five year bonus but it helps lower the premium.

So How Should Businesses Manage NCB?

Businesses should:

-

Maintain claims logs

-

Use telematics to improve risk

-

Use driver coaching

-

Report accidents early

These actions strengthen renewal results, even without a formal bonus.

No claims bonus works differently for business vehicles, company cars and fleets. The owner of the vehicle earns the discount, not the driver. Fleets do not collect it at all. Understanding these rules helps businesses keep costs down and helps drivers avoid surprises when they switch between company cover and personal policies.