A commercial property incident — whether fire, flood, theft or structural failure — can be disruptive and costly. Acting quickly and carefully, while following your insurance policy, helps protect your business. It also makes the claim process easier and reduces financial loss. Below are the key steps to take immediately after an incident.

1. Ensure Safety and Secure the Scene

The first priority after any incident is people’s safety. If there is a risk to life or danger from hazards like fire or building collapse, evacuate. Call the emergency services for help.

Once professionals have declared the property safe to enter, secure the site to prevent further damage or theft. This could include boarding up windows, covering damaged roofs or restricting access to unsafe areas. Most commercial policies implicitly require you to mitigate further loss to protect your claim.

2. Notify Your Insurer Promptly

Contact your commercial property insurer as soon as possible. Policies often require prompt notification and may include specific timeframes for reporting incidents.

When you call, have your policy number, location, a clear description of the event and initial damage details ready. The insurer will log the claim. They will also explain the next steps. This includes if emergency services are available through their claims team.

3. Document the Damage

Strong documentation is critical to a successful claim. Before repairs begin, gather evidence such as:

- Photos and videos of all affected areas from multiple angles

- A written inventory listing damaged equipment, stock or fixtures

- Date and time the damage was discovered

- Any police or fire incident reports where relevant

Keep digital and physical copies of all documentation. This evidence supports the insurer’s assessment and can prevent disputes later in the process.

4. Record Communications and Decisions

Maintain detailed records of all correspondence related to the incident and claim. This includes:

- Emails and phone call summaries with insurers

- Contractor quotes for emergency work

- Meetings with adjusters or surveyors

Insurance claims often involve many stakeholders, and keeping accurate logs can reduce confusion and expedite resolution.

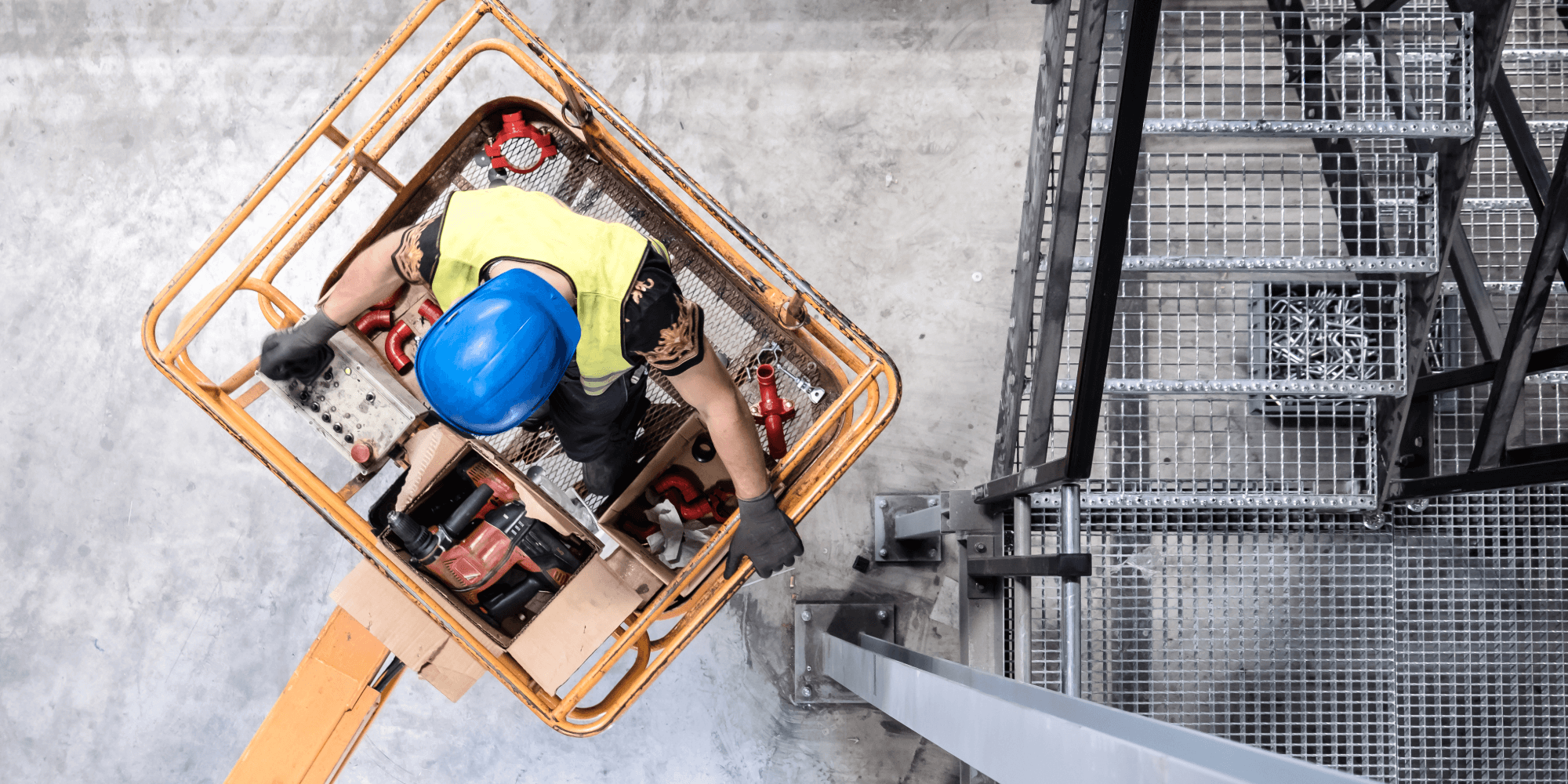

5. Meet with the Loss Adjuster

Once you have reported the incident, your insurer will usually appoint a loss adjuster. Loss adjusters represent the insurer and will inspect the site, assess damage extent, and verify coverage. Be prepared to walk through the incident with them and provide documentation. They help form the foundation of how much the insurer will pay out.

6. Appoint Support Professionals

In many incidents, especially where losses are significant, businesses choose to appoint a loss assessor or an independent surveyor. These experts work on your behalf and can manage claim preparation, negotiation and documentation. Many commercial clients find this helpful in complex claims. This is especially true when multiple coverages, such as contents, building repairs, and business interruption, come into play.

7. Mitigate Further Losses

Insurance policies typically require the insured to take reasonable steps to reduce ongoing loss. This might include:

- Arranging temporary repairs

- Protecting remaining assets from weather or theft

- Continuing operations in alternate locations

These actions demonstrate to your insurer that you are actively managing the loss and can help with business continuity.

Final Note

Commercial property incidents can be stressful. However, quick and organised action after an event helps with safety and compliance. It also makes the claims process more effective.

By documenting the event, involving the right experts, and talking early with your insurer, you protect your business.

For more information on commercial property insurance, talk to one of our experts on the number below.