Dumper trucks are tough machines, but they’re not immune to risk. From theft to tip-overs, the types of claims insurers see from UK construction and groundwork firms often follow a...

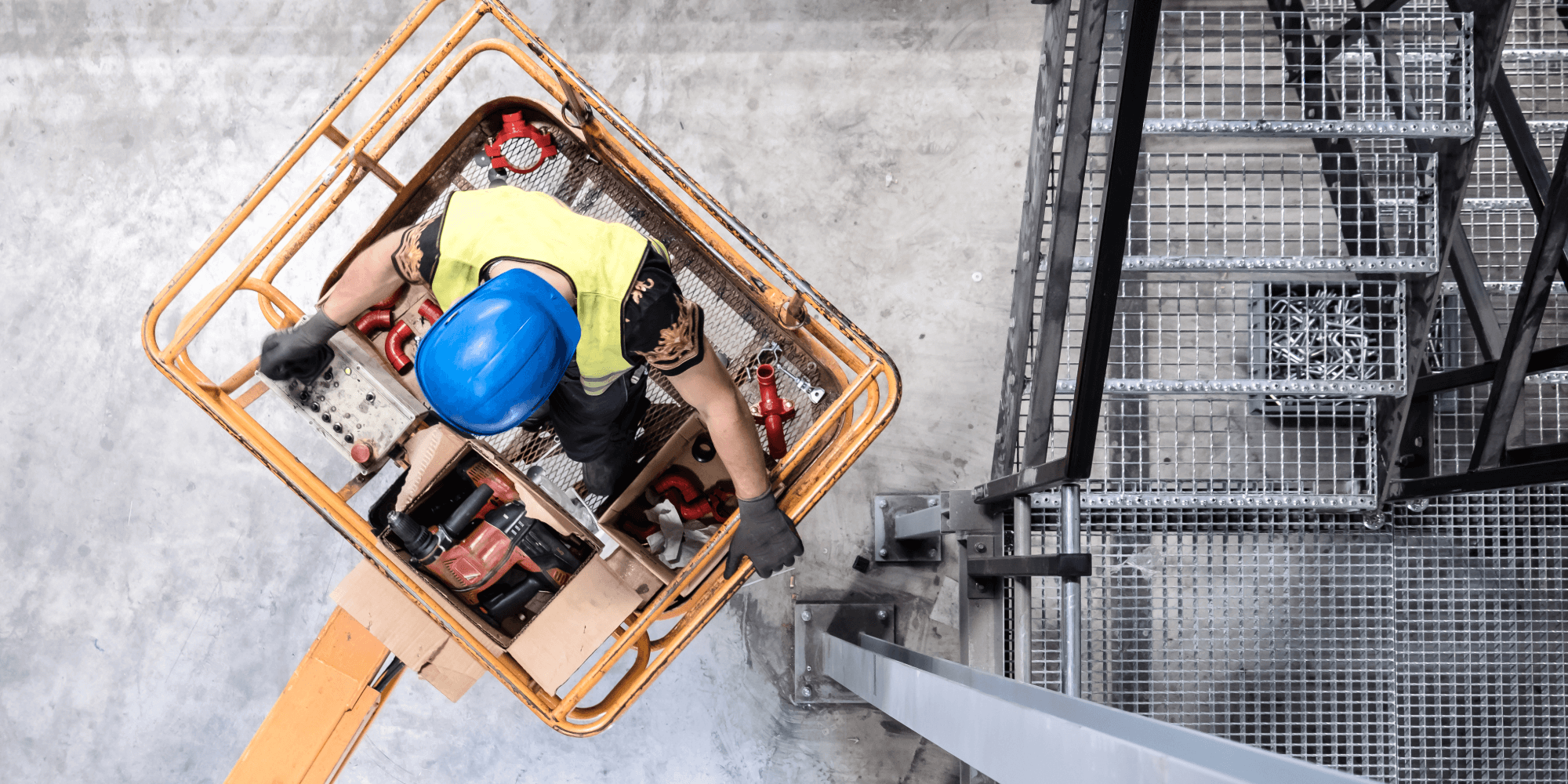

Cherry Picker Insurance

If you operate a cherry picker or powered access platform, having the right insurance isn’t just smart, it’s essential. Whether you use van-mounted lifts, self-propelled booms, or MEWPs on construction or maintenance sites, we offer tailored Cherry Picker Insurance to keep you compliant, protected and moving.

We work with specialist UK insurers to offer flexible, affordable cover that protects your business, your equipment, and your liability.

1

Call us or fill in our quick online form. We’ll ask for key details about your cherry picker and how you use it.

2

We’ll review your info and call to discuss your cover needs, whether your equipment is owned or hired, road-registered or site-only.

3

We compare quotes from top UK insurers. You choose the best policy, and we arrange instant cover to get your cherry picker protected fast.

Insurance Revolution's Reviews

What Is Cherry Picker Insurance?

Cherry Picker Insurance is a specialist policy that protects mobile elevated work platforms (MEWPs), including van-mounted booms, self-propelled lifts, and telescopic platforms. These machines face unique risks on-site, on the road, and in storage, from tipping accidents to theft and third-party damage.

This type of insurance provides financial protection for:

-

Damage to the cherry picker

-

Theft or vandalism

-

Public liability if your equipment causes injury or damage

-

Road use (if applicable)

-

Hired-in cherry picker liability

Whether you own a single boom lift or manage a fleet of access platforms, we’ll make sure you have the right level of cover in place.

Who Needs Cherry Picker Insurance?

You’ll likely need Cherry Picker Insurance if:

-

You own or hire a cherry picker or MEWP for work

-

Your cherry picker is driven on public roads

-

You work on building, repair, telecoms, tree surgery or signage contracts

-

You operate van-mounted, tracked, trailer-mounted or self-propelled booms

-

You’re required to show evidence of insurance for a site contract or hire agreement

It’s suitable for sole traders, contractors, limited companies, and plant hire businesses.

What Does Cherry Picker Insurance Cover?

A typical Cherry Picker Insurance policy can include:

-

Accidental Damage: Cover for collisions, tipping, or operational mishaps.

-

Theft & Vandalism: Protection if your cherry picker is stolen or maliciously damaged.

-

Road Risks Cover: Compulsory third-party or comprehensive insurance if it’s used on public roads.

-

Public Liability: Covers injury or property damage caused by your equipment.

-

Hired-In Plant Cover: Insures cherry pickers you’ve rented, including continuing hire charges.

-

Legal Expenses: Optional cover for defending or pursuing claims related to the equipment.

-

Breakdown or Replacement Hire (optional): Support to minimise downtime after an incident.

We tailor policies to suit you, whether it’s a van-mounted lift working across multiple sites or a static self-propelled boom used on industrial projects.

FAQs

Yes. Even if your cherry picker is only used on private sites, it still faces risks like tipping, theft or third-party injury. Insurance protects your business from major costs.

Yes. MEWP (Mobile Elevated Work Platform) insurance is a broader term that includes cherry pickers, scissor lifts and boom lifts. Our policies are designed specifically for these machines.

Absolutely. We offer hired-in plant cover, which protects you against theft or damage to rented cherry pickers, plus any continuing hire charges.

Yes, provided you’ve met the policy’s security conditions (such as immobilisers, fenced sites, or CCTV where required). Theft cover is a key part of most policies.

Yes, especially if your cherry picker could injure someone or damage property while in use. Many policies include public liability, or we can arrange separate cover if needed.