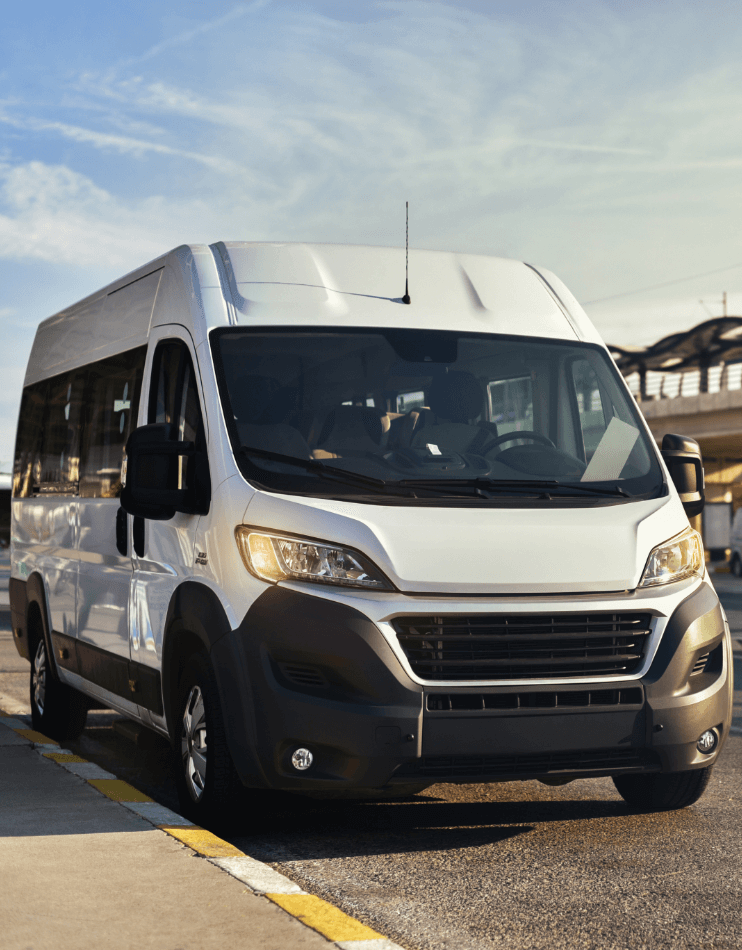

Minibus Insurance

At Insurance Revolution, we work with a panel of trusted UK minibus insurance companies to find you affordable, tailored cover designed for commercial use.

1

Tell us about your minibus: Taxi, hire, school, or business transport.

2

We compare insurers: Access leading UK minibus insurance brokers.

3

Get covered today: Choose flexible, affordable commercial cover.

Insurance Revolution's Reviews

What Is Minibus Insurance?

Minibus insurance protects vehicles with 9–16 passenger seats. It’s available for private hire, taxi minibuses, and commercial operators, providing protection against accidents, theft, liability claims, and more.

Who Needs Minibus Insurance?

This insurance is suitable for:

- Schools, colleges, charities, and community groups

- Taxi and private hire operators

- Businesses transporting staff or customers

- Fleet operators (see our Minibus Fleet Insurance page)

Why Do You Need Minibus Insurance?

Minibuses carry more passengers than standard vehicles, creating more risk. Insurance helps you:

-

Stay legal with road risk cover

-

Protect passengers with liability cover

-

Safeguard vehicles against theft and damage

-

Cover hire or reward use with taxi insurance

-

Minimise downtime with optional breakdown cover

START YOUR QUOTE >

What Does Minibus Insurance Cover?

A tailored policy may include:

-

Road Risk Cover – Comprehensive, third party, fire & theft

-

Public Liability Insurance – Protects against passenger or public claims

-

Employers’ Liability Insurance – A legal requirement if you employ drivers

-

Any Driver Cover – For maximum flexibility

-

Goods/Passenger Liability Cover – Extra protection when needed

-

Breakdown & Recovery – UK and EU options

-

Legal Expenses Cover – Support with claims and disputes

FAQs

Costs vary depending on use (private, taxi, hire), driver history, and vehicle details.

No, we do not offer minibus insurance for personal use only.

Yes, if you operate for hire or reward, you’ll need minibus taxi insurance.

Yes, you can request a minibus insurance online quote quickly.