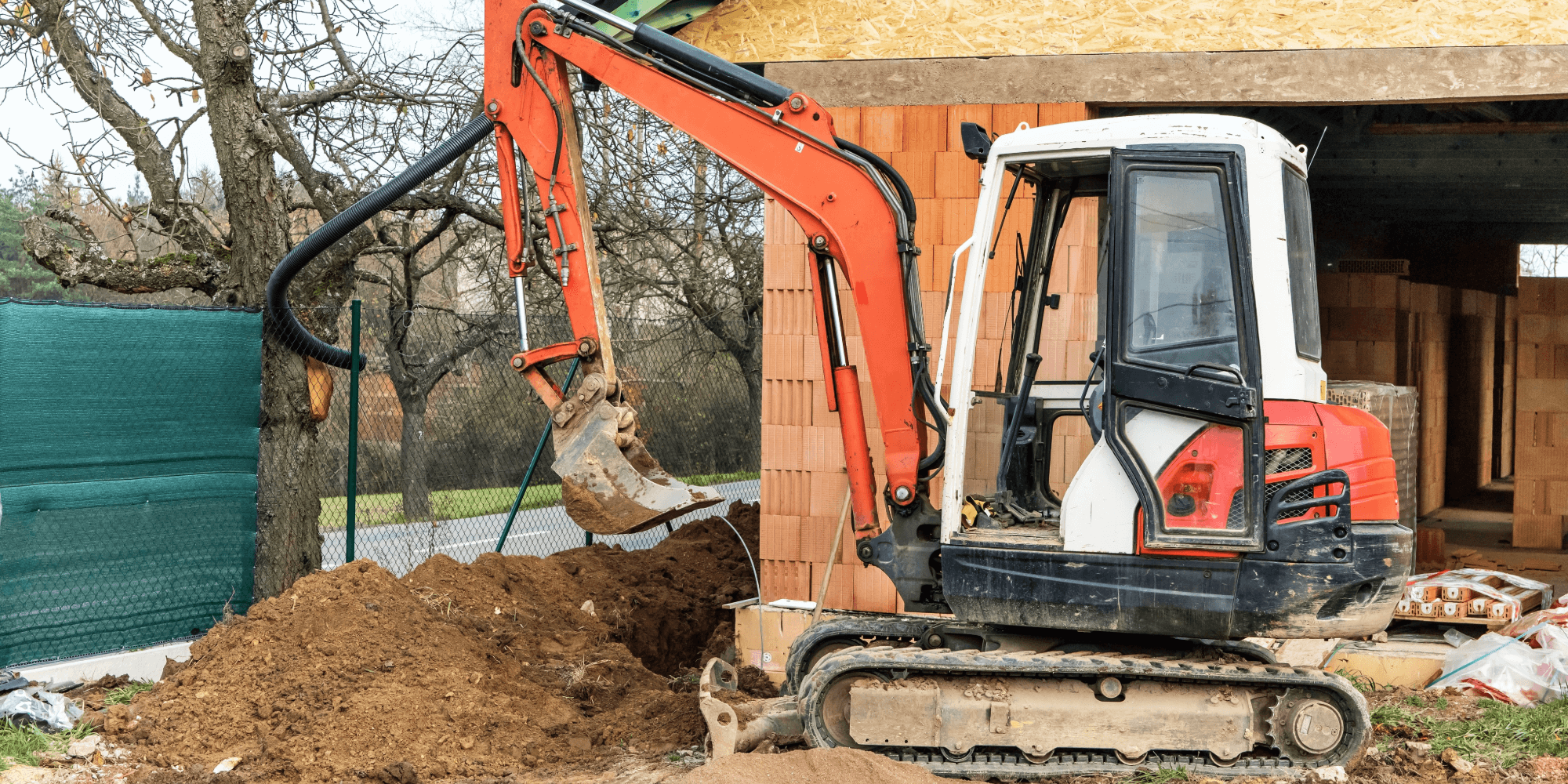

If you operate a digger or excavator whether it’s a mini digger, tracked machine or wheeled unit, having the right insurance isn’t just a box-tick exercise. With high theft rates, expensive repairs, and strict hire conditions, digger insurance plays a vital role in protecting your business.

This short guide covers who needs it, what it covers, and what happens if you go without.

What Is Digger Insurance?

Digger insurance protects your machine from accidental damage, theft, vandalism, fire, and more. It can also cover you for public liability and ongoing hire costs if the digger is rented.

Cover applies to:

-

Owned diggers used in your business

-

Hired-in diggers rented under CPA terms

-

Mini diggers, midi and large excavators

-

Machines used on-site or in transit

Policies can be tailored depending on how often you use the digger, whether it goes on public roads, and if employees operate it.

Who Needs It?

You’ll likely need digger insurance if you:

-

Run a construction, groundworks, or landscaping business

-

Hire diggers for site work (even short-term)

-

Own plant equipment and use it commercially

-

Transport machinery between job sites

-

Operate under contracts that require liability or plant cover

Even sole traders or small firms working on domestic sites can benefit, particularly given how frequently diggers are targeted by thieves.

Is It a Legal Requirement?

There’s no legal obligation to insure a digger used solely on private land but there are key exceptions:

-

If it’s road registered, road risk insurance is mandatory

-

If you hire plant, your CPA contract may make you liable for all damage or loss

-

If you work on commercial or public sites, clients may require proof of cover and liability insurance

In short: while not always legally required, digger insurance is often contractually required and financially essential.

What Happens If I Don’t Have It?

Going without insurance could leave you exposed to:

-

Full cost of theft (mini diggers are among the most stolen machines in the UK)

-

Repair or replacement costs from accidental damage

-

Hire charges if a hired digger is unusable

-

Third-party claims for injury or property damage

-

Breach of contract or site bans for failing to show proof of insurance

The cost of a single uninsured incident can easily exceed £30,000, far more than an annual premium.

Final Thoughts

If a digger plays any role in your business, don’t leave it uninsured. Whether you own, hire or lease your machine, the right policy protects your investment and your operations and gives peace of mind on every site.