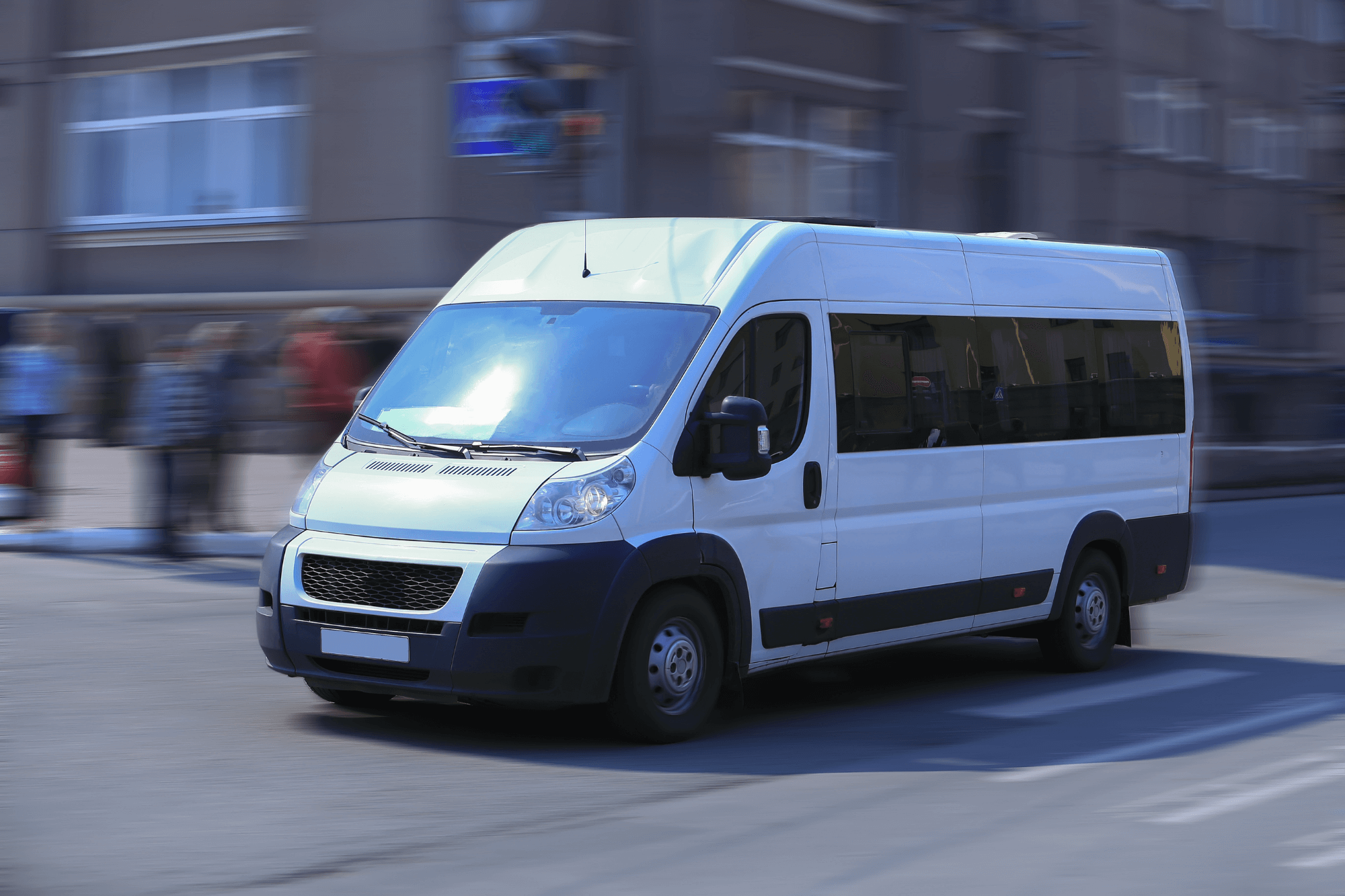

Operating a minibus can be rewarding, but it comes with risk. Vehicles face heavy use, carry passengers and travel long distances. Without proper cover, one incident could lead to serious financial loss. Mini Bus Insurance shields operators from the most common and costly problems.

1. Accidents on the Road

Minibuses are larger and harder to manoeuvre than standard cars. Even experienced drivers can face accidents, especially on busy or narrow routes. Comprehensive Mini Bus Insurance covers repair or replacement costs and protects against claims from other drivers or passengers.

2. Passenger Injury Claims

Carrying multiple passengers increases exposure to injury claims. A sudden stop, collision or slip while boarding could result in expensive legal action. Passenger liability within Mini Bus Insurance pays compensation and legal defence costs.

3. Theft or Vandalism

Minibuses are attractive to thieves due to their size and value. Even attempted theft or vandalism can leave vehicles unusable. Cover within Mini Bus Insurance helps pay for repairs or replacement and can include recovery if the vehicle is stolen.

4. Breakdowns and Journey Disruption

Breakdowns leave passengers stranded and harm reputation. Many Mini Bus Insurance policies include roadside assistance and onward travel so trips continue with minimal disruption.

5. Loss of Income

If a minibus is out of action after an accident or theft, operators may lose bookings and income. Some Mini Bus Insurance options cover loss of use or help fund replacement vehicles to keep services running.

Why Standard Vehicle Cover Falls Short

Car or van insurance may meet basic legal requirements but often excludes passenger-related risks, loss of income and specialist breakdown support. Using the wrong policy can lead to rejected claims and unexpected bills.

Choosing the Right Protection

Before buying Mini Bus Insurance, review:

-

Number of passengers carried

-

Vehicle storage and security

-

Annual mileage and route type

-

Any use for hire and reward

-

Need for replacement vehicles if one breaks down

A broker can recommend the right level of protection and save money by avoiding unnecessary extras.

Keeping Your Business Moving

Accidents, theft and breakdowns happen when least expected. With the right Mini Bus Insurance, operators stay legal, protect passengers and reduce financial loss. Tailored cover keeps services running and customers confident. If you’re looking for a minibus insurance quote, fill out our online form and we will be in touch!