- Agricultural machinery

- Cherry pickers

- Combine harvesters

- Cranes

- Excavators and diggers

- Forklift trucks

- Lorry and van mounted cherry pickers

- Lorry...

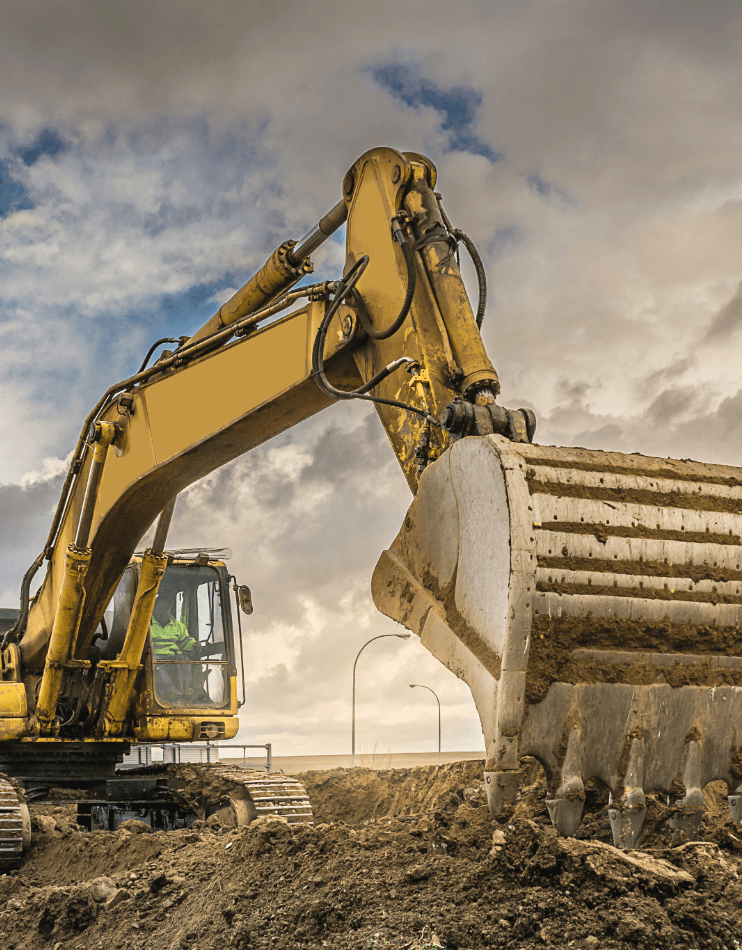

Digger & Excavator Insurance

1

Call us or fill in our quick online form. We’ll ask for key details about your digger or excavator and how you use it.

2

We’ll review your info and call to discuss your cover needs, whether your equipment is owned or hired, road-registered or site-only.

3

We compare quotes from top UK insurers. You choose the best policy, and we arrange instant cover to get your digger protected fast.

Insurance Revolution's Reviews

What Is Digger Insurance?

Digger insurance is a specialist policy that protects your plant machinery from damage, theft, breakdown or legal claims. It is essential for excavators used on UK sites, especially as these machines are often left unattended or transported between jobs.

It covers a wide range of machinery, including:

-

Mini diggers (micro & compact models)

-

Tracked and wheeled excavators

-

360° swing excavators

-

Long reach & high-reach machines

-

Hire-in diggers or leased equipment

Whether your machine is used for demolition, trenching, loading, or site prep, we’ll build a policy that fits your work.

Who Needs Digger Insurance?

This cover is ideal for:

-

Construction firms operating diggers on-site

-

Plant hire businesses renting out diggers to contractors

-

Landscapers or groundwork contractors

-

Owner-operators using mini diggers

-

Businesses with hired-in equipment

If you rely on diggers to complete your projects, insurance gives you peace of mind and financial protection when things go wrong.

What Does Digger & Excavator Insurance Cover?

Your policy can include cover for:

-

Accidental damage from use on site

-

Theft or vandalism, including unattended sites

-

Fire, flood or storm damage

-

Loss or damage during transport

-

Hired-in plant and continuing hire charges

-

Public liability insurance – if your digger causes third-party injury or damage

-

Employer’s liability insurance – if you have operators on staff

-

Optional extras – such as breakdown, legal expenses, or business interruption

Attachments like buckets, grabs, augers and breakers can also be insured under your policy.

FAQs

It’s not a legal requirement, but highly recommended. Theft, damage or liability claims can cause serious financial loss – especially with hired-in plant.

Yes. Buckets, rippers, augers, and other attachments can be included in your policy’s sum insured.

Yes – your cover can include damage or loss while the digger is being transported between sites, whether by trailer or low-loader.

We offer hired-in plant cover that protects you for accidental damage, theft, and any hire charges you may owe if the machine is out of action.

Absolutely. We can set up multi-machine policies for companies running multiple diggers, whether owned or hired-in.