- Agricultural machinery

- Cherry pickers

- Combine harvesters

- Cranes

- Excavators and diggers

- Forklift trucks

- Lorry and van mounted cherry pickers

- Lorry...

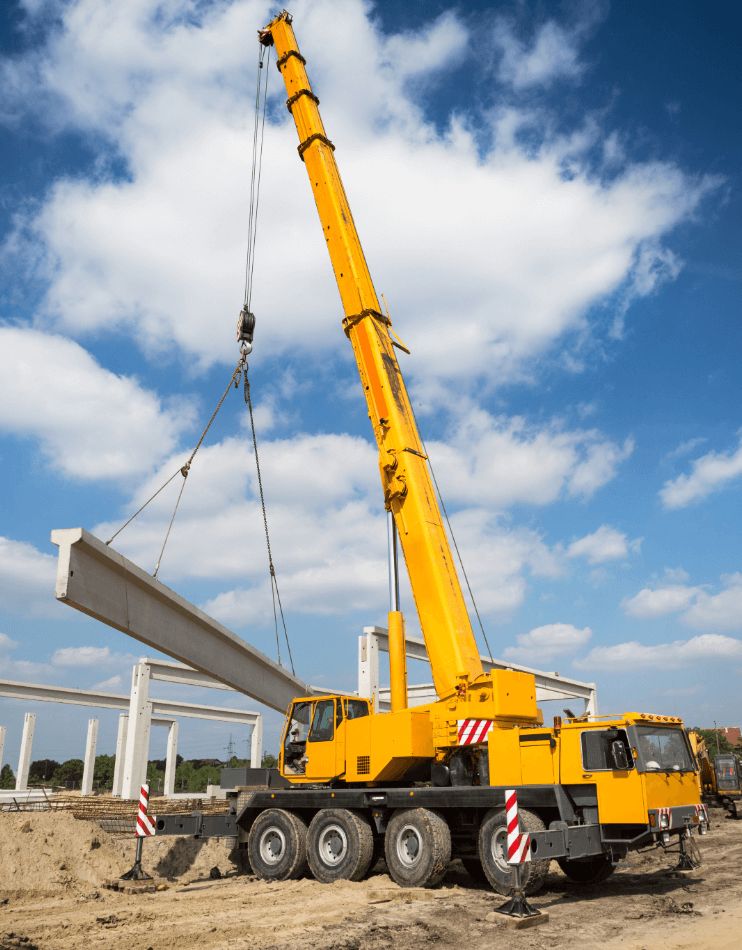

Crane Insurance

1

Call us or fill in our quick online form. We’ll ask for key details about your crane(s) and how you use it.

2

We’ll review your info and call to discuss your cover needs, whether your equipment is owned or hired, road-registered or site-only.

3

We compare quotes from top UK insurers. You choose the best policy, and we arrange instant cover to get your crane protected fast.

Insurance Revolution's Reviews

What Is Crane Insurance?

Crane insurance is a specialist commercial policy that protects crane operators, contractors, and hire businesses from the unique risks involved in lifting operations. Standard commercial or plant policies rarely offer adequate protection for cranes due to their complexity and the high liability involved.

Our crane insurance policies can be tailored for:

-

Mobile cranes

-

Tower cranes

-

Vehicle-mounted lifting equipment

-

All-terrain and rough-terrain cranes

-

Self-erecting or crawler cranes

The policy can include road risk (if the crane is road-registered), loss or damage cover, and protection against third-party claims for injury or property damage. You can also include contract lift insurance, which covers your liability when supplying the crane, operator, and planning expertise.

Who Needs Crane Insurance?

This cover is vital for:

-

Crane hire businesses (with or without operators)

-

Construction contractors using lifting equipment

-

Steelwork, infrastructure, or plant installation firms

-

Logistics and heavy goods movers

-

Companies managing contract lifts

If you operate cranes, store them, transport them, or supply operators for client jobs, a dedicated crane insurance policy ensures you’re covered if something goes wrong.

What Does Crane Insurance Cover?

We’ll help you build a policy that includes all the protection you need:

-

Loss, theft or accidental damage to your crane

-

Third-party road risks (for road-registered cranes)

-

Public liability cover – if your crane causes injury or property damage

-

Employer’s liability – for crane operators or lift supervisors

-

Contract lift insurance – liability cover when you provide the full lifting service

-

Hired-in cranes and continuing hire charges

-

On-site and off-site cover including during transit

-

Optional breakdown, business interruption, or legal expenses cover

Whether you own, lease, or hire cranes, we’ll make sure every risk is covered.

FAQs

Yes. Even if your crane is site-based, you still face risks like theft, damage, or liability during lifting operations. We’ll tailor cover to suit non-road use.

Crane hire means the client takes responsibility for planning and operation. Contract lift means you (the crane supplier) are liable. We’ll ensure you have the right liability cover.

Yes. We offer cover for hired-in cranes, including responsibility for damage and any continuing hire charges you may owe if the crane is out of use after an incident.

Accidental damage caused by the operator can be covered, depending on the policy. We’ll advise on including this, especially if you supply drivers as part of the contract.

Absolutely. We regularly arrange cover for multiple cranes, including tower and mobile cranes. Fleet-style policies can save you money and simplify renewals.