- Agricultural machinery

- Cherry pickers

- Combine harvesters

- Cranes

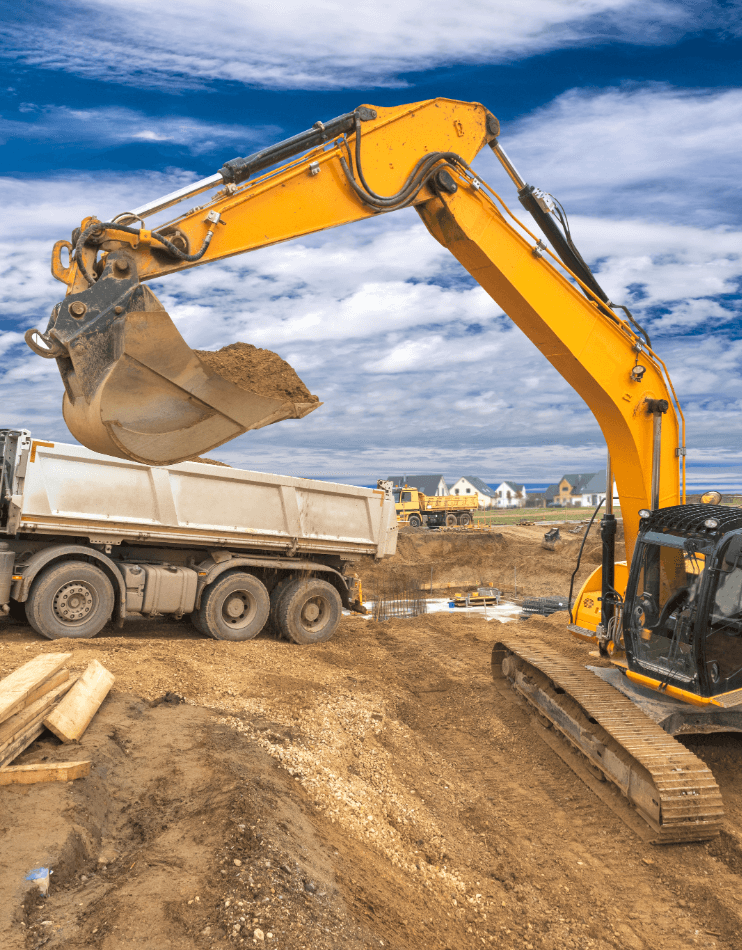

- Excavators and diggers

- Forklift trucks

- Lorry and van mounted cherry pickers

- Lorry...

Plant & Machinery Insurance

As one of the UK’s leading specialists in Plant & Machinery Insurance, we leverage our strong relationships with top insurers to find you flexible cover at competitive prices. Our experienced team understands the construction industry and ensures you get the right protection for your machinery, so your business stays covered when it matters most.

1

Request a Quote Contact our team or complete an online quote form. We’ll gather a few key details about your business, the plant machinery you use, and the cover you need.

2

Discuss Your Needs We’ll review your details, discuss your needs, and match you with the right cover based on your equipment.

3

Compare and Choose We compare quotes from leading UK insurers, explain your tailored options, and set up cover immediately once you choose the right policy.

Insurance Revolution's Reviews

Plant & Machinery Insurance: What You Need to Know

Plant & Machinery Insurance brings together essential protections to safeguard the machinery and equipment your business relies on. Standard commercial vehicle or property insurance often won’t cover specialised plant used on construction sites or other work environments. A dedicated plant insurance policy fills that gap by covering a wide range of risks specific to heavy equipment.

What does it cover?

In general, a Plant & Machinery Insurance policy will cover the cost of repair or replacement if your insured items are accidentally damaged, lost or stolen. This applies whether the equipment is on your site, in storage, or in transit between locations. For example, if an expensive excavator or forklift is damaged on site or a generator or cement mixer is stolen from a lockup overnight, your policy can compensate you so you can repair or replace it promptly. Plant insurance can also extend to cover attached tools and accessories, and many policies offer optional add-ons like continued hire cost cover (to pay for rental charges if hired plant is out of action) or road risk cover for mobile plant that travels on public highways.

Common Risks in Plant Operations

Construction and engineering firms face daily risks when using heavy machinery. Plant & Machinery Insurance helps protect against common threats like theft, damage and liability.

Theft and Vandalism: Plant equipment is a frequent target, especially overnight. Insurance covers stolen or vandalised diggers, loaders or other machinery, helping reduce downtime and financial loss.

Accidental Damage: Even skilled operators can cause damage. A toppled excavator or dropped tool can sideline equipment. With the right cover, repair or replacement costs are handled quickly.

Fire, Flood and Weather: On-site plant is vulnerable to fire, flood and storm damage. A strong plant insurance policy protects against these natural risks, ensuring your machinery is not left unusable.

Transit and Off-Site Risks: Machinery in transit or stored off-site can be damaged or stolen. Plant insurance includes transit cover, so your equipment is protected wherever it goes.

Third-Party Liability: If your machinery causes injury or property damage, such as a crane tipping over, the right policy can include liability cover to protect against legal claims and costs.

Without proper insurance, these events could cause serious delays or major costs. Plant & Machinery Insurance helps you recover fast, minimising disruption and keeping your business running smoothly.

FAQs

Anyone using high-value machinery or equipment for business purposes should consider Plant & Machinery Insurance. If you’re a building contractor, civil engineer, landscaper, farmer, or any tradesperson operating plant (from small diggers and forklifts to large cranes and bulldozers), this cover is essential. Standard commercial insurance policies won’t typically cover specialised plant at work sites. Even if you only use hired equipment occasionally, you are usually liable for it while it’s in your possession, so without insurance you’d have to pay out of pocket for any theft or damage. In short, if losing or damaging a piece of machinery would hurt your business financially, then you need plant insurance to stay protected.

A typical plant insurance policy covers your contractors’ plant and equipment against “All Risks” of physical loss, theft or accidental damage, anywhere in the UK. This usually includes risks like fire, flood, storm damage, collapse, overturning, theft, vandalism and other sudden unforeseen events.

For owned plant, it pays for repair or replacement if your machinery is damaged or stolen (at the site, in transit, or even while stored). For hired-in plant, it covers the hire charges or replacement costs you’d owe the rental company if something happens to their equipment on your watch. Some policies automatically include cover for equipment attachments and accessories, as well as debris removal costs if a machine is wrecked on-site.

It’s important to note that if any insured machines will be driven on public roads, you should have a Road Risks extension for third-party motor liability(since by law road-going vehicles require that). Plant insurance can often be customised with add-ons too, for example, adding breakdown cover, increased limits, or hiring out cover if you rent your own plant to others. We’ll help you choose the right mix of coverages so that everything important is protected and no gaps are left in your policy.

Yes – even if you hire plant infrequently, you should still have insurance for it. When you rent equipment from a hire company, the contract will almost always state that you are responsible for loss or damage during the hire period. The hire company’s insurance won’t cover you; in fact, they will expect you to reimburse them for any stolen or damaged kit. Hired-In Plant Insurance is designed for this exact situation. It can be arranged for short-term hires (even on a per-project basis) or as an annual policy covering all equipment you hire in over the year.

The insurance will cover the cost of repairing or replacing the hired machine if something goes wrong, as well as any continuing hire charges (since the hire firm might charge you rent until a damaged item is fixed or a stolen item is replaced). Without this cover, even a one-off incident, like a rented mini-digger being vandalised or a hired generator catching fire could leave you facing thousands of pounds in bills. It’s simply not worth the risk. We can set up affordable hired-in plant cover to keep you protected, no matter how occasionally you rent machinery.

The cost of plant insurance depends on several factors, so it can vary widely. Insurers will look at the value of your equipment, the types of machinery and what they’re used for, as well as where they are kept or operated (security and location can influence risk). They’ll also consider whether the plant is owned or hired, if you ever hire your own equipment out to others, how often it’s in use, and your past claims history. As a rough idea, premiums for an annual contractors’ plant policy might start around a few hundred pounds for a small business, but larger companies with multiple machines could pay more.

The good news is there are ways to keep premiums cost effective. Keeping your kit secure (e.g. using immobilisers, trackers and secure lock-ups) can earn you discounts. Maintaining a good claims record and implementing safety measures (like regular maintenance and operator training) will also make insurers more inclined to offer better rates.

We’ll help you find the most competitive quote by shopping our panel of insurers and making sure you’re only paying for the coverage you need, nothing more. Remember, the price of insurance will always be far cheaper than the cost of replacing a stolen excavator or facing an uninsured liability claim, so it’s a smart investment in your business’s continuity.

Absolutely. Plant & Machinery Insurance isn’t a one-size-fits-all product, and that’s exactly why working with a specialist broker is beneficial. We take the time to understand your operations so we can customise the policy around your specific requirements. You can choose the coverage limits and options that make sense for you. For example, you might opt for: cover on a replacement as new basis for newer equipment, add hired-in plant cover up to a certain value, include transit cover if you frequently move machines between sites, or add public liability cover into the package.

If you have multiple pieces of plant, we can either list them individually or set a blanket limit for unspecified equipment (useful if your inventory changes often). Policies can also be arranged for short-term projects or on an annual basis covering all projects – whichever suits your business model.

Our role is to ensure you’re fully protected without paying for extras you don’t need. We’ll guide you through the available options (like increasing cover during peak periods or adding seasonal hire cover) and craft a tailored insurance solution that gives you peace of mind that every angle is covered. In the end, you get a bespoke policy that aligns perfectly with how you operate, so you’re not over-insured or under-insured, but just right.