Warehouses play a vital role in keeping goods moving across the UK. From storing retail stock to managing complex logistics, they face daily risks that can quickly disrupt business. Theft, fire, equipment breakdown and supply chain delays all have the power to stop operations. That is why Warehouse Insurance is an essential safety net.

Why Warehouse Insurance Matters

A warehouse is far more than a storage unit. It is often the hub of a company’s supply chain, where valuable stock, specialist equipment and staff work together to keep goods flowing. Any interruption can lead to missed deliveries, unhappy customers and major financial loss.

Warehouse Insurance protects against the most common risks faced in this environment. It goes beyond simple property cover to safeguard stock, staff and income if something goes wrong.

Key Risks That Warehouse Insurance Can Address

Warehouses face a wide mix of dangers that ordinary property policies may not fully cover:

-

Fire and flood damage that destroys goods and equipment

-

Theft or vandalism targeting high-value stock

-

Equipment breakdown stopping forklifts, conveyors or security systems

-

Injury to staff or visitors caused by slips, trips or machinery

-

Supply chain disruption delaying customer deliveries and cash flow

Without tailored cover, these events can cause long and costly downtime.

Core Covers Within Warehouse Insurance

Property and Stock Protection

Stock is often a warehouse’s most valuable asset. Fire, flood or theft can wipe out thousands of pounds of goods overnight. Warehouse Insurance includes property and contents cover to repair damage to buildings and replace lost or damaged stock quickly.

Business Interruption Cover

Even if damage is repaired, operations can stay closed for weeks. Business interruption within Warehouse Insurance replaces lost income and pays essential running costs such as staff wages and bills until normal service returns.

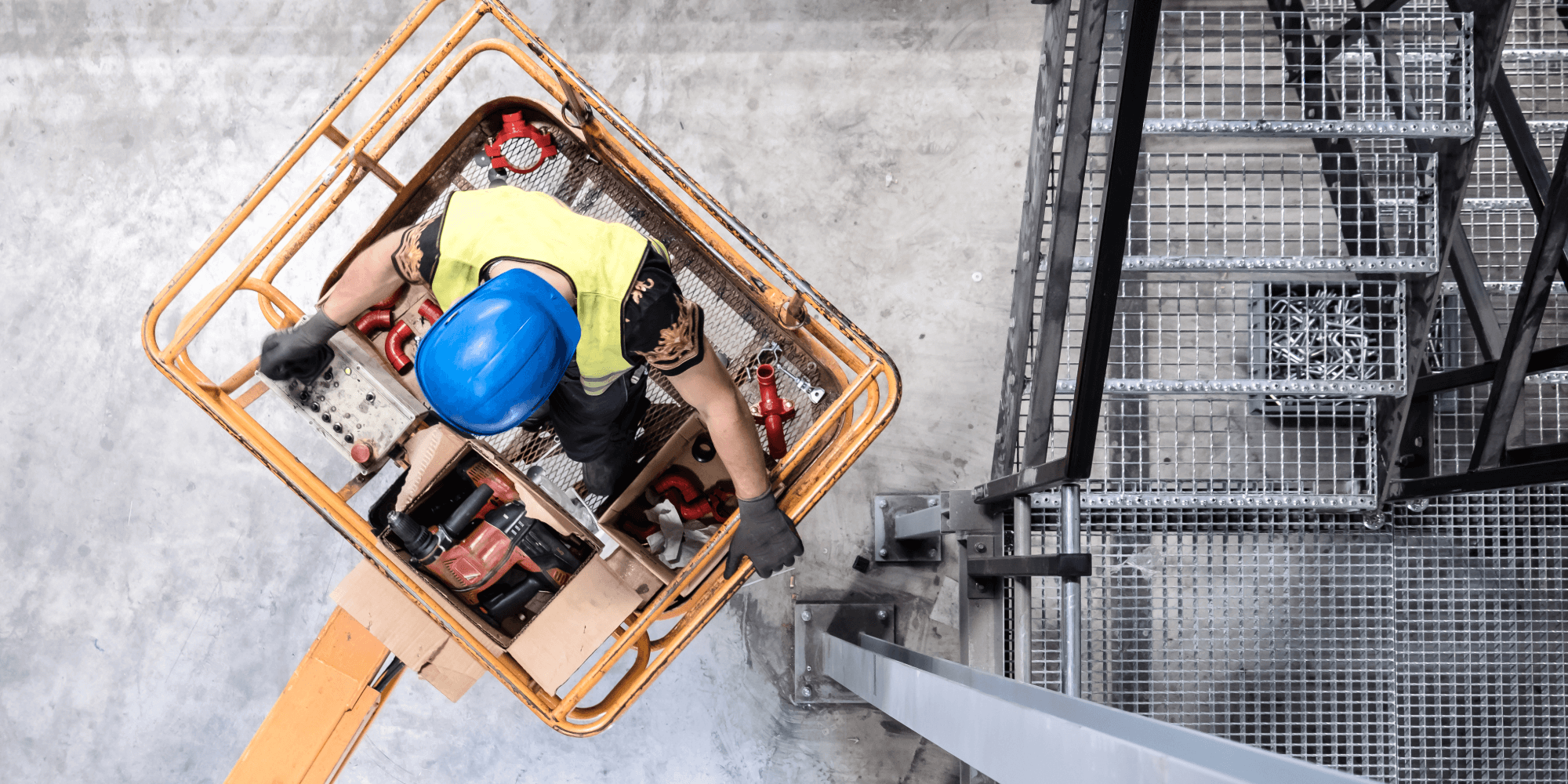

Employers’ Liability for Warehouse Staff

Warehouses can be busy, high-risk workplaces. Forklifts, pallets and heavy lifting increase the chance of injury. UK law requires employers’ liability insurance for any business with staff. Including this in Warehouse Insurance protects against compensation claims and ensures legal compliance.

Public Liability for Visitors and Contractors

Delivery drivers, contractors and visitors regularly enter warehouses. If someone is injured or their property is damaged, the business may be liable. Public liability cover within Warehouse Insurance helps with legal fees and compensation costs.

Equipment and Machinery Cover

Modern warehouses rely on forklifts, conveyors, packing lines and security technology. A breakdown can halt work and delay orders. Warehouse Insurance with equipment cover funds repairs or replacements, keeping goods moving.

Supply Chain Protection

Some policies can include cover for losses caused by supply chain disruption. If a key supplier fails or transport delays cause downtime, this part of Warehouse Insurance helps reduce financial damage.

How to Choose the Right Warehouse Insurance

Not every warehouse is the same. A small e-commerce fulfilment centre will have different needs to a large cold-storage facility. To arrange the right Warehouse Insurance, consider:

-

The total value of stock at any one time

-

The type of goods stored (fragile, perishable or high-value)

-

Machinery and equipment critical to operations

-

The number of staff and safety procedures in place

-

How dependent the business is on key suppliers and hauliers

Working with a specialist broker can help identify the right mix of cover and avoid paying for extras you do not need.

Strengthening Your Warehouse With Tailored Insurance

Running a warehouse involves more than protecting a building. Stock, staff and supply chains are the heart of the business. Warehouse Insurance gives confidence that if fire, theft, equipment failure or delivery disruption occurs, the financial impact will not stop operations for long.

A tailored policy supports long-term growth by keeping goods moving, protecting employees and helping the business bounce back from unexpected events.