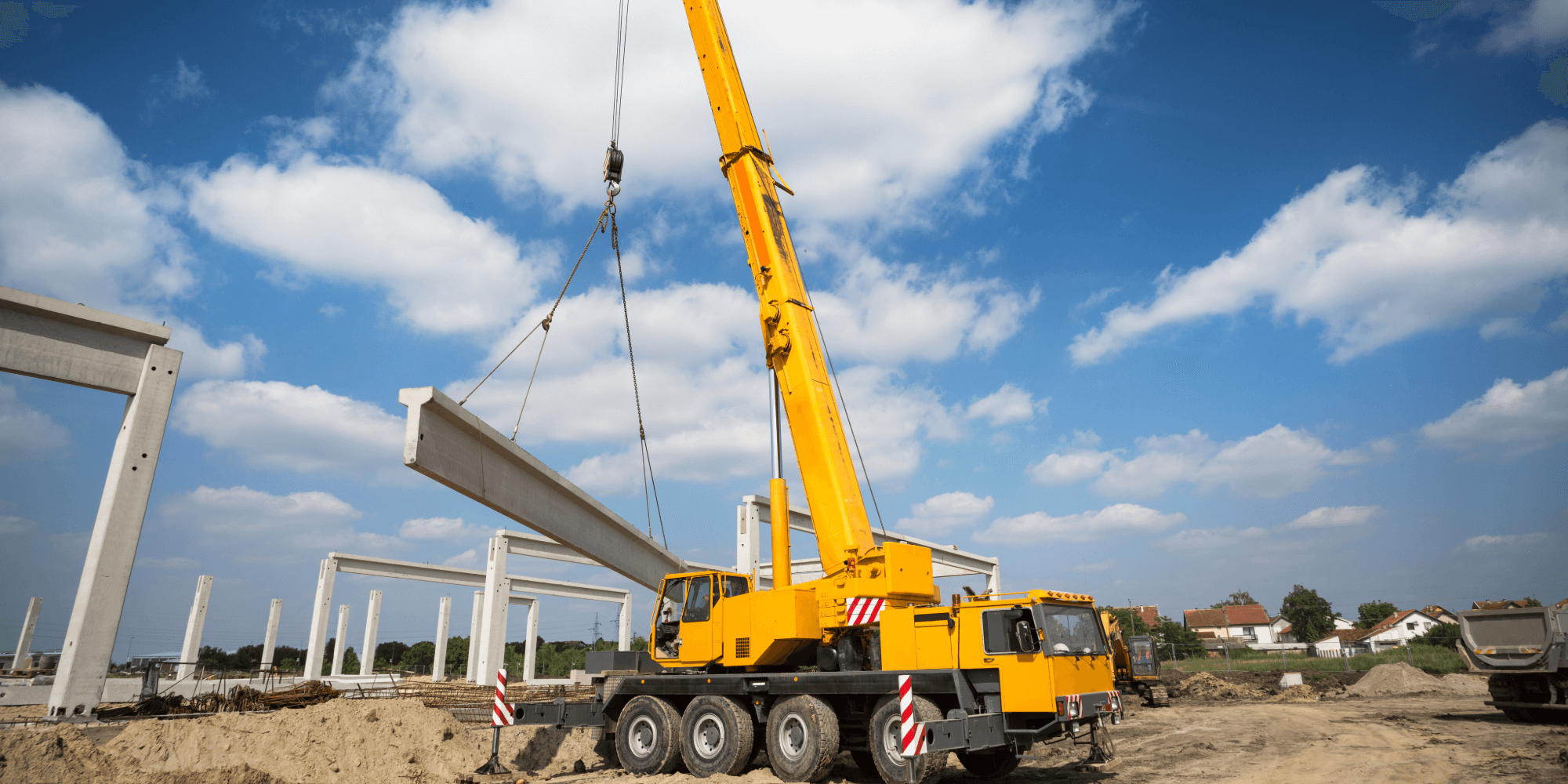

Crane operations are some of the most high-risk activities on a construction site. A single incident can lead to serious injury, project delays, and six-figure insurance claims. Whether you’re operating mobile cranes, tower cranes, or hiring under CPA terms, understanding the top risks, and how to mitigate them is essential.

Here are the most common causes of crane insurance claims in the UK, and practical steps you can take to reduce your exposure.

1. Crane Collapse Due to Ground Conditions

The risk: Cranes are heavy machines that need stable footing. Inadequate ground preparation, soft soil, or overloaded stabilisers can lead to tipping or collapse.

How to reduce it:

-

Conduct a geotechnical site survey before setup

-

Use outrigger mats or steel pads to spread the load

-

Follow manufacturer stabilisation instructions precisely

-

Document pre-use checks and operator reports

Insurance impact: Collapse due to poor ground prep may lead to denied claims if negligence is proven.

2. Overloading or Incorrect Lifting

The risk: Lifting a load beyond the crane’s rated capacity can cause mechanical failure or tip-over. Claims often arise when operators exceed limits under pressure or miscalculate weights.

How to reduce it:

-

Use lifting plans and load charts for every job

-

Train operators thoroughly on load assessments

-

Have a lift supervisor on site for complex operations

-

Use certified lifting accessories with traceable records

Insurance impact: Lifting-related liability may not be included in standard crane insurance, check your policy for lifting cover or extensions.

3. Collision with Buildings or Overhead Power Lines

The risk: Crane booms, jibs, or counterweights can strike adjacent buildings, vehicles or utilities if operating in tight areas without sufficient clearance.

How to reduce it:

-

Perform a full site survey and mark exclusion zones

-

Use banksmen or spotters when operating near structures

-

Install limiters and anti-collision sensors on mobile cranes

-

Notify local authorities or utility companies when required

Insurance impact: Third-party damage or injury can lead to public liability claims make sure your cover includes adequate limits.

4. Equipment Theft or Vandalism

The risk: Cranes left unattended on unsecured sites can be targeted for fuel theft, vandalism, or even parts stripping, especially in remote areas.

How to reduce it:

-

Use CCTV, fencing, and motion-activated lighting

-

Remove keys and secure controls

-

Install GPS tracking or immobilisers

-

Store mobile cranes off-site when possible

Insurance impact: Theft cover may be restricted if security measures aren’t in place or the site is left open, check your policy conditions.

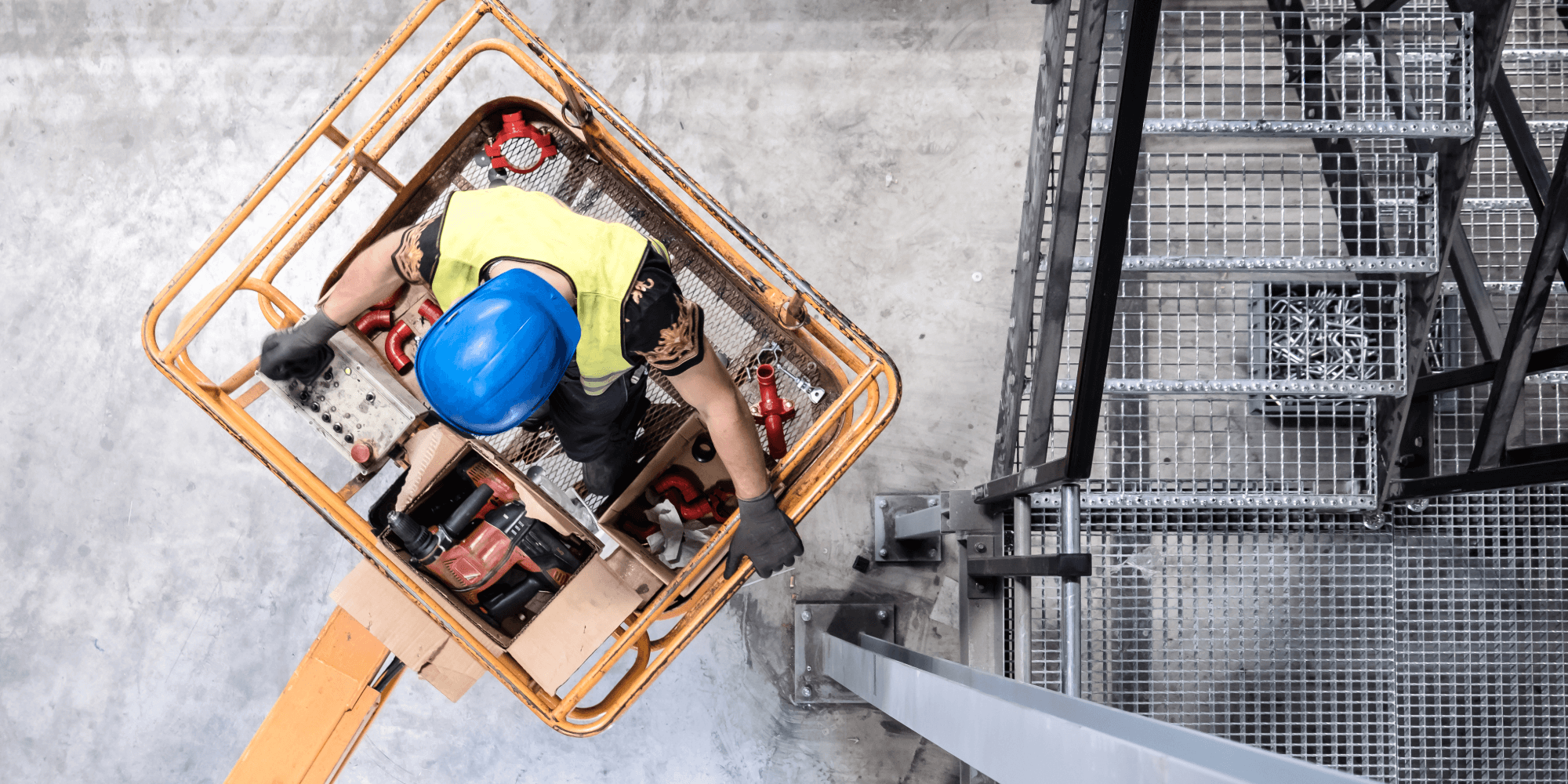

5. Improper Use by Untrained Operators

The risk: Unlicensed or inadequately trained crane operators are a major risk. Mistakes in setup, lifting, or communication can cause catastrophic incidents.

How to reduce it:

-

Verify all operators are CPCS or NPORS qualified

-

Keep records of training and refreshers

-

Enforce strict supervision on high-risk lifts

-

Use contract lifts if no internal expertise is available

Insurance impact: Claims may be rejected if the operator is unqualified or not authorised to use the crane.

Final Thoughts

Crane insurance is essential but it’s only as good as your on-site risk management. By tackling the root causes of common claims, you protect not only your premiums, but also your people, clients, and reputation.